Insufficient funds could result in cards becoming inactive or decline fees being charged. Free from overdraft fees.

How To Add Money To Visa Prepaid Spend Card Busykid

How To Add Money To Visa Prepaid Spend Card Busykid

They can buy stock.

Busykid debit card. While there is no ATM access for cards. Ideal for kids 5-16 BusyKid is a financial literacy system that helps children develop basic yet important money management routines they will need as adults and this starts by having them use a debit card for kids at a young age. Check your childs balance.

This is one of the best chidred debit card i ever used it keep track of there money. Cards must have money loaded onto them through the BusyKid app before use and card holders should make sure a sufficient balance is available before making any purchases. A 55 fee will be added to the price of the card if purchased using a credit card.

It will teach them money manage skill and to ke. The BusyKid Visa Prepaid Spend Debit card is best for parents who are looking beyond chores and allowances. Download BusyKid - Debit Card For Kids and enjoy it on your iPhone iPad and iPod touch.

BusyKid Visa Prepaid Spend Cards can be used anyplace Visa cards are accepted whether in store or online. BusyKid is also less expensive than Greenlight. Check out the list below and see which of these debit cards for kids will work best for helping you teach minors to manage money.

Ideal for kids 5-16 BusyKid is a financial literacy system that helps children develop basic yet important money management routines they will need as adults and this starts by having them use a. - Allows alerts to be set on Spend Cards for low balances. App appears to be good although getting your 1st debit card is a slow process unfortunately for my ever so anxious son.

Read reviews compare customer ratings see screenshots and learn more about BusyKid - Debit Card For Kids. - Has the most advanced SSL encryption and is FDIC Insured. Although Greenlight also offers investing.

You and your child can. Available debit cards for up to five kids. Before the card can be used your kids a parent can also load.

Each additional card 799yr. Not only that having a debit card for kids will take the spending freedom and responsibility of your child to the next level. If you want to set up BusyKid accounts for multiple children youll pay an additional 799 per child per year.

A BusyKid family plan costs 1999 per year and comes with one BusyKid prepaid Visa spend card. For your safety BusyKid. Greenlight is a debit card that is made for kids but managed by parents.

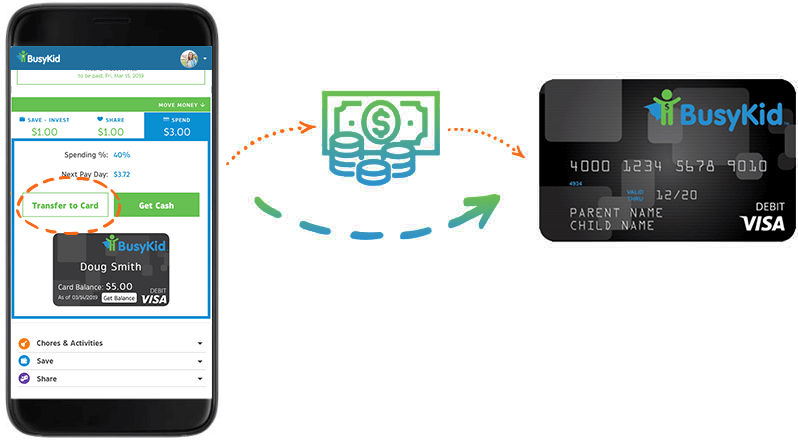

You may use your BusyKid Spend Card to purchase or lease goods or services everywhere Visa debit cards Interlink cards and Star cards are accepted as long as you do not exceed the value available on your BusyKid Spend Card Account. Instantly transfer funds anytime and anywhere. Its safe because it only allows kids to spend the money approved by a parent and its protected the same way as other VISA debit cards.

Once you receive the card get started in three ways. It has several great features. The BusyKid VISA Prepaid Spend Debit Card is a safe and easy way for kids to get hands-on experience in managing and spending invisible money.

As you are still in this window of time I would not worry about it My son is excited about this and to be considerably. Transfer money to the debit card by signing in to your childs account or completing a card-to-card. Emailed customer service 11 days after opening account and received this message BusyKid spend cards are taking between 10-14 mailing days to arrive after being made.

Call the number on the cards sticker to activate it. - Individual PINs on accounts and Spend Cards. Busykid offers a way for your kid to save donate share spend or invest any earned allowances.

One Busykid Spend Card is included in your 1999 annual family subscription so theres no reason why you shouldnt begin teaching your child how to spend responsibly. 12 Zeilen Everyone wants the most for their money so thats why BusyKid is the perfect fit for any. Ideal for kids 5-16 BusyKid is a financial literacy system that helps children develop basic yet important money management routines they will need as adults and this starts by having them use a.