Investing in senior housing can consume time money and energy. These facilities exist to provide an assisted living environment for their residents to continue to live engaged social and active lifestyles while their physical.

The Investment Case For Senior Housing

The Investment Case For Senior Housing

As a real estate investor you need to recognize how many citizens need assisted living services.

Investing in senior living facilities. A key component of the Senior Housing markets success is its lack of reliance on a particular economic or real estate environment. During the same quarter growth in occupied units caught up to growth in newly available units for the first time in over three years indicating increased demand for rooms in the facilities. Because theyre more active more involved and more fit older adults today are interested in lifestyles that will keep them active and healthy for years to come.

Being an operator has many requirements but it can be the most profitable. Senior living facilities fulfill a need thats never going to go away so putting your money into either physical senior living centers or senior living real estate investment trusts REITs is a. Investing in fast-growing markets has the potential for excellent returns over time.

Real estate investors gain numerous opportunities from assisted living investments. Memory care facilities are licensed healthcare facilities that specialize in caring for senior adults living with Alzheimers Disease Dementia and other cognitive impairments. Its much more fruitful than the typical single- and multi-family investments.

In freestanding a facility serves a specific purpose such as just only independent living. Todays senior citizens are also. Why Investing in Senior Living Facilities Makes Sense In the past several years senior living facilities have emerged as a high-performing commercial real estate asset class.

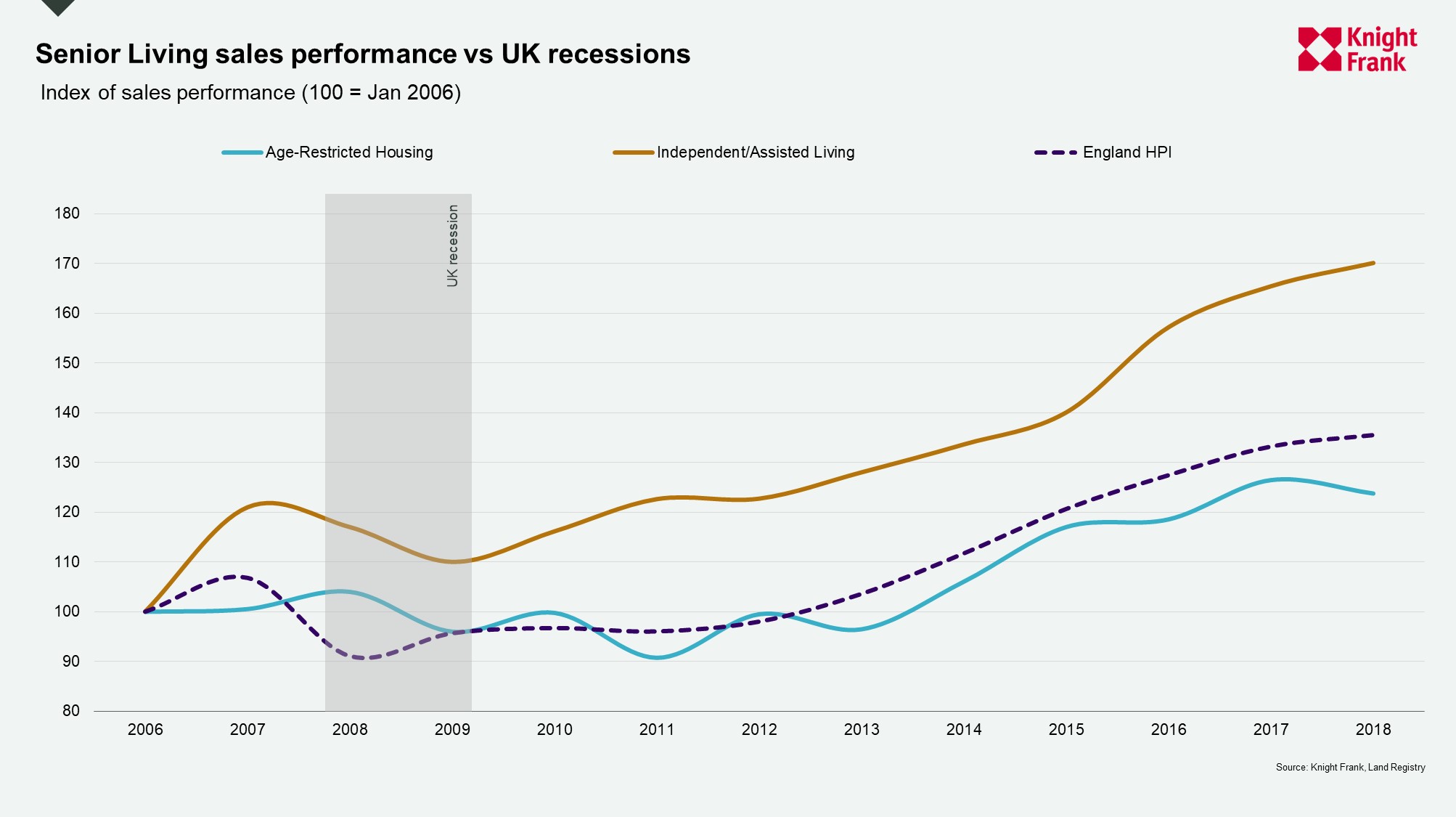

The total market capitalization of ALF and senior housing investment is estimated at over 250 billion 2. A major benefit of investing in senior housing real estate is the resiliency of this sector. Like all property types senior housing investments have their own business cycle.

The requirements for owning an assisted living facility depend on the state you plan to invest in. According to the PwCs Emerging Trends in Real Estate 2019 Report investing in senior housing is once again one of the best bets for real estate investment. The investment will bridge the Property during its lease-up period typically 12-18 months until stabilization.

The property features of major senior living investment types are either freestanding or campus style. Investing in senior housing is different than other types of real estate investment such as single or multi-family properties. At this point the Department of Housing and Urban Development HUD provides a public service via cheaper loans to the senior living facility to help maintain the business plan and refinance prior investments.

Nonetheless the demand for senior housing properties is far less affected by the rise and fall in employment or the expansion and contraction of gross national income GNP. Senior living facility investments are typically made after the facility opens. Read about the pros and cons of senior housing investments and why you should work with an experienced real estate professional when investing.

In fact it already is it stays steady as the economy shifts up and down with a 136 percent return on investment in the previous seven years and a. Investing now in senior living facilities in all their forms could turn into a very lucrative investment in the next decade. After all assisted living facilities are constantly being built across the United States.

While turnover may be less frequent it can be challenging to quickly find a new resident who meets the age and income requirements of a facility. Within this broad category there are REITs that invest in senior-oriented apartments and communities assisted living facilities and related properties such. The graying of America is no secret.

It has its own risks and rewards. Cons of Investing in Senior Housing. Investing in senior housing is an unpopular trend you want to be in on.

A major benefit for investors in the Senior Housing space is the resiliency of this particular sector of the commercial market. The senior housing and care sector is generating buzz with more real estate investors hopping on board. More so understand that this number rises on a daily basis.

Bonus Secret 6 Senior living real estate investment trust also known as REIT is a great alternative. Among the primary senior living types Independent living is more likely to be freestanding because it has a limited operation or minimum service. Senior Housing Is A Recession Resilient Asset Class.

Home Research Education Additional Resources 6 Steps to Increase Revenue for Your Senior Living Facility Todays aging population is not the same as it was in years past. One unique downside to senior housing investments is the deteriorating health of the residents. One market that has tremendous growth potential over the next few decades is senior housing.

One option for investing in a senior living facility is to become an operator and manage the business yourself.