TRENDS IN HEALTHCARE VENTURE CAPITAL INVESTING HIGHLIGHTED VC HEALTHCARE DEALS KEY TAKEAWAYS Tokyo has emerged as the center of healthcare companies receives 1BB in funding in 2020. US and EU VC investment in life science and healthcare companies surges.

Here Are 4 Key Trends In Vc Healthtech Investment Pitchbook

Here Are 4 Key Trends In Vc Healthtech Investment Pitchbook

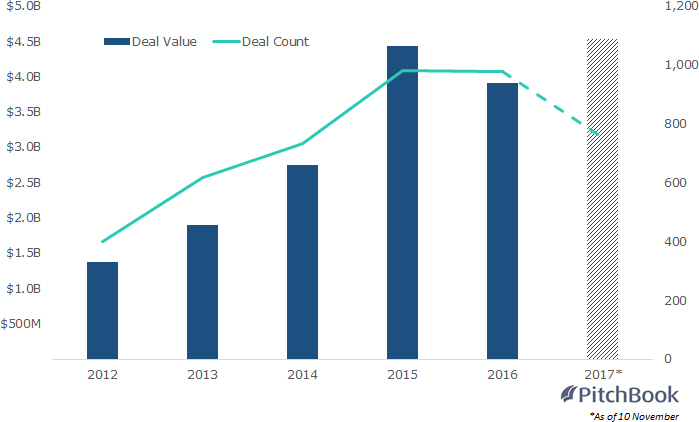

Just Now US healthcare venture capital fundraising A flurry of venture fundraising in 1H 2020 nearly eclipsed 2019s full-year record 107B 104B building on a three-year trend of increased allocation to healthcare.

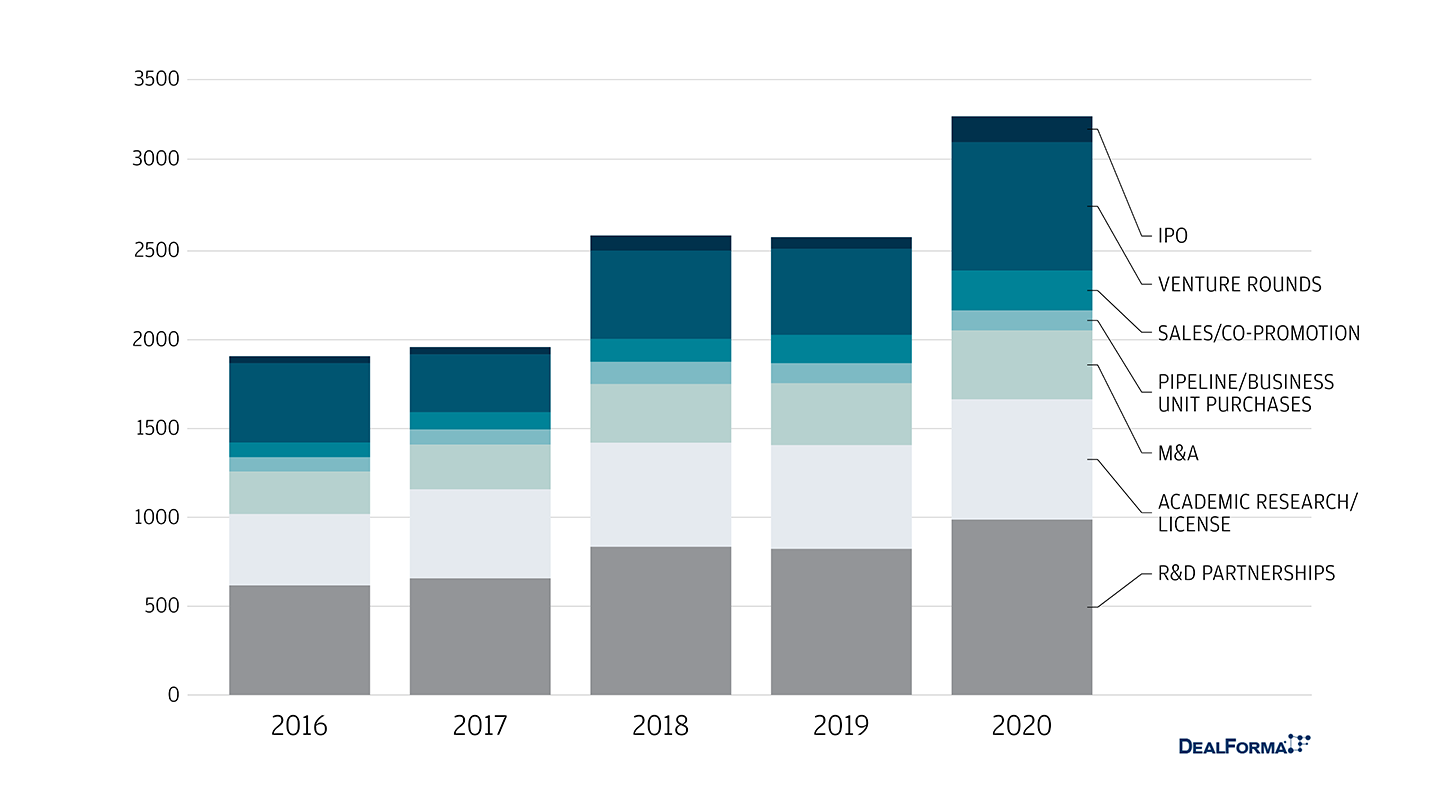

Healthcare venture capital trends. Investments in VC-backed biopharma continued to surge while device remained stable. Retailers creating health products and tools 5. Healthcare tech deals made up only 7 percent of European and US healthcare deal volume from 2015 to 2018 and 83 percent of global healthcare tech deals occurred in the United States over this period Exhibit 2.

OurCrowd provides an early investing opportunity to vetted tech startups alongside VCs. Venture Capital and Its Latest Trends During 2021. We saw new levels of venture fundraising total investment values acquisitions and initial public offerings.

Completed VC deals in healthtech by geography. Healthcare business productivity and fintech startups have dominated the unicorn class of 2020 as an exponential rise in demand for services in these sectors during the coronavirus pandemic has changed VC investing trends. They are determined to be the driving force for new innovative business projects.

Veröffentlicht am 05082020 Die Corona-Pandemie führte im ersten Halbjahr dazu dass weltweit besonders viel Risikokapital in Gesundheitstechnologien und Diagnostik investiert wurde. A flurry of venture fundraising in 1H 2020 nearly eclipsed 2019s full-year record 107B 104B building on a three-year trend of increased allocation to healthcare. Digital mental health solutions 3.

US healthcare venture fundraising reaches 96 billion a record. Even as the economy and industries including the health care industry reel under the impact of the COVID-19 pandemic venture funding for these innovators nearly doubled in 2020 compared to 2019 figure 1. Highlights in 2018 include.

Deloittes 2019 Global Health Care Outlook report predicts an annual increase of 54 for global healthcare spending over the next three years potentially reaching 1006 trillion by 2022. The latest PitchBook-NVCA Venture Monitor sponsored by Silicon Valley Bank Perkins Coie and Shareworks takes a deep dive into other trends in the US venture capital industry from 2Q 2019. Anzeige Invest in vetted startups exclusive venture funds.

9 health tech trends drawing venture capital 1. It includes a spotlight on the growing healthtech sector investment trends for female-founded companies and how fundraising might bounce back as exit gains flow back to LPs. Join in OurCrowds next success.

US healthcare venture capital fundraising. Patients turning into consumers 2. That is going to change due to a number of well-funded startups like Heal and Ready.

Often stereotyped as targets more suitable for venture capital than for PE healthcare tech sees relatively few deals especially outside the United States. VCs have poured 35 billion into about 371 different digital-health deals and financing companies in the second quarter of this year and these three firms are among the most active in. During the pandemic venture capitalists have still been buzzing with activity.

Healthcare delivery in more convenient places 6. The report cites an increased use of exponential technologies and entry of disruptive and non-traditional competitors as part of the main driving force behind the industrys continued growth and. Join in OurCrowds next success.

Anzeige Invest in vetted startups exclusive venture funds. Big data and genetics personalizing healthcare 7. Of the 10 largest deals in 2017 eight have occurred in the US with the other two in China.

2020s unicorns highlight shift in venture capital funding trends. House calls from doctors havent been the norm for quite some time. CBD and cannabis 4.

Trends in Healthcare Investments and Exits Mid-Year 2018 3 At mid-year US. In 2020 venture funding for health tech innovators crossed a record US14 billion. However there are signs of a slight rebound as this years share of roughly 68 is ahead of the 645 the US registered in 2016.

Healthcare venture fundraising reached 45 billion and is on pace to closely match the 2017 record of 91 billion. The doctor is coming to you. Over the last 5 years in Japan there has been an emergence in investments in technology-centered biotech cell therapies and precision medicine.

OurCrowd provides an early investing opportunity to vetted tech startups alongside VCs. Fullyear 2018 investment in -.