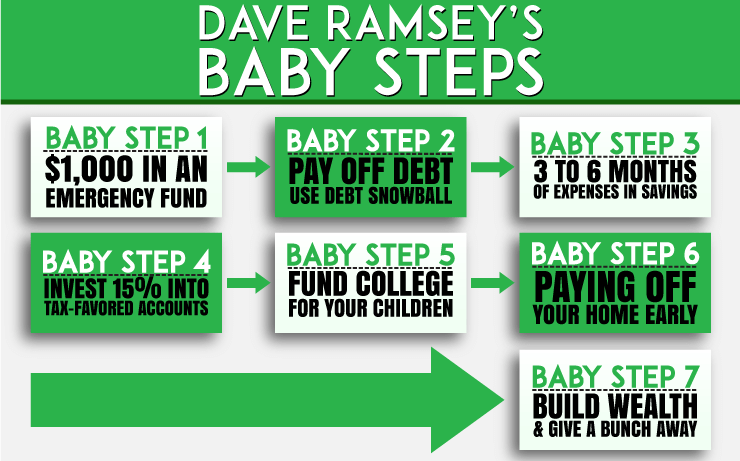

This baby steps list is a breakdown of each of the steps youll follow as you move through the plan. Save for your childrens college fund.

Dave Ramsey S Baby Steps My First Hand Experience

Dave Ramsey S Baby Steps My First Hand Experience

Second while you get rid of the existing debt create a game plan to pay for upcoming large purchases with cash.

Dave ramsey steps to debt free. Once you pay off the smallest debt take that payment and apply it to your next-smallest debt. Theres no shame in accepting or asking for unwanted old furniture from family or friends. We call this being gazelle intense.

Free Printable Debt Thermometer. Dave Ramseys debt-free plan consists of his seven baby steps sometimes referred to as the Total Money Makeover Steps and the debt snowball method. Your goal in baby step 2 is to become completely debt free except for the house.

Using cash to budget means youve accounted for every penny and know where. So find your animal instinct. Dave Ramsey is an American financial guru.

Dave Ramseys whole system is built around 7 baby steps the first two being 1 save for a 1000 emergency fund and 2 Attack debt using a snow ball method where you pay off the smallest debt first. Save 36 months of expenses in a fully funded emergency fund. We asked Indiana University Professor Kristoph Kleiner an assistant professor of finance at IUs renowned Kelley School of Business to help us evaluate Ramseys baby steps.

For the purpose of this post Im going to share all the Dave Ramsey money saving tips that will help you become debt free. The Frugal Foot Doc has a printable budget binder that will help you get your debt paid off. Run Forrest run.

The first step in Dave Ramseys 7 Baby Step Plan is to save 1000. He is most well known for his Baby Steps process and utilizing the Debt Snowball Method to become debt-free. Youre going to need it on your debt-free journey.

Invest 15 of your household income in retirement. The foundation of Dave Ramseys financial plan centers around seven baby steps. In addition his plan also focuses on purchasing the materials for his Financial Peace University.

The Debt Snowball Method of debt reduction is just one of Ramseys famous 7 Baby Steps to living debt-free and living the life you want. Use the cash envelope method to budget. List your debts from smallest to largest regardless of interest rate.

Build wealth and give. Whether youre just starting to pay off your debt or youre a few years in and ready to kick it into high gear sign up for your free trial of Ramsey. Most Dave Ramsey tips include advice to get you to spend less with a preference being on taking advantage of free stuff whenever possible.

How I used Dave Steps to become debt-free. He has a no-nonsense approach and encourages followers to stick to his rules backed up by his reasoning. You want to get out of debt like a gazelle gets out of harms wayfast.

Save 1000 for a starter emergency fund. Top 5 Tips For Success with Dave Ramseys UK Debt Free Method 1. Pay off all debt using the debt snowball method.

Its no secret here at the Frugal Sisters we love to budget and save money anywhere and everywhere we can. Attack the smallest debt with a vengeance while making minimum payments on the rest of your debts. Wellits actually not as hard as it first seems.

This first step is to act as an emergency fund for any unexpected expenses that arise while paying off your debt. Pay off your home early. Youll listen to or watch The Dave Ramsey Showa lot.

Go For Free Stuff Whenever Possible. Pay off all debt except the house using the debt snowball. Dave Ramsey Baby Steps List.

Become Debt-Free with Dave Ramseys Baby Steps. Your Ramsey membership will help you knock out debt even faster with tools like Financial Peace University the BabySteps app that will help you track your progress and the premium version of EveryDollar plus a ton of other exclusive content. Another fantastic tool is our printable debt thermometer.

Seems easy when you put it like that right. One person we stumbled across on our journey to become debt-free was Dave Ramsey. First develop a three- to five-year strategy to eliminate the debt by allocating a percentage of monthly profits to debt reduction.

Check out this Dave Ramsey-inspired 1000 Emergency Fund Tracker from Penny For Your Thoughts. This will prevent you from falling back to borrow money with a high interest rate. Pay off all your non-mortgage debt using the debt snowball method.

Pay Off Debt Fast. Eliminating debt saving for the future and paying off your home are all financially important goals but trying to do them all at once will dilute your efforts. Pay Off All Non-Mortgage Debt Using the Debt Snowball.

Repeat this method as you plow your way through debt. Dave Ramsey believes that by following his Seven Baby Steps people can achieve Financial Peace. Along the way to frugality we have come across some inspiring individuals.

You can find the Dave Ramsey Radio Show on Youtube. Dave Ramseys 1st baby step UK to be debt free is to save an emergency fund of 1000 for those unplanned and costly events in life.