David on Quartz watch. I would recommend Circle Back Lending to anyone looking to get a loan online.

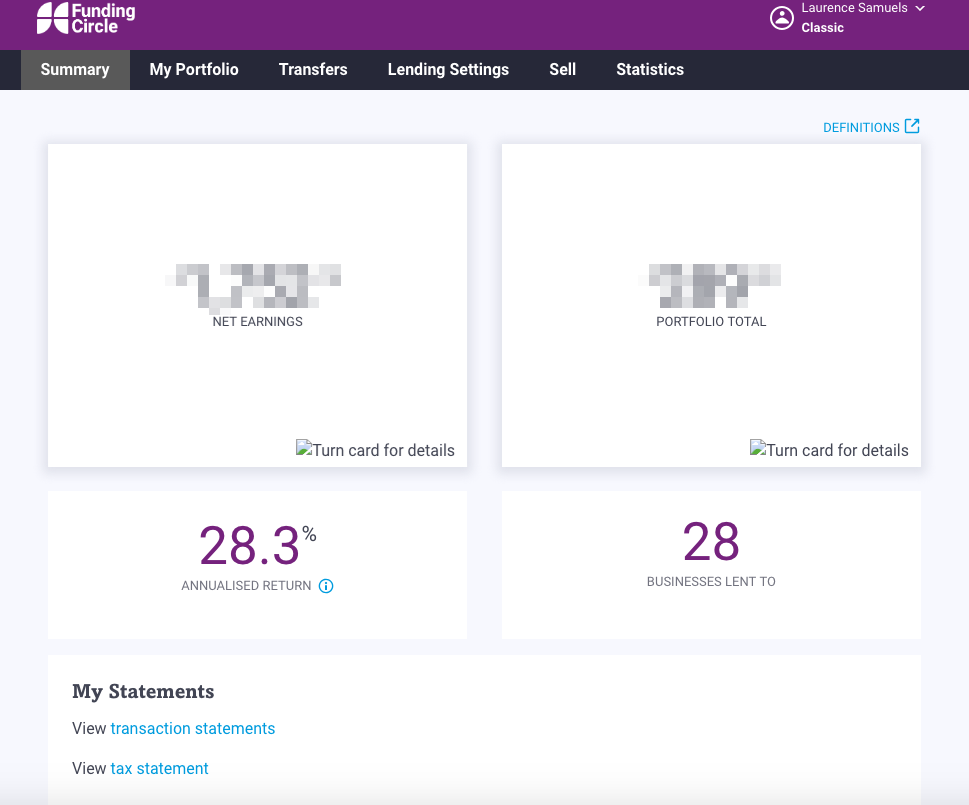

Funding Circle Review My Lender Experiences After 5 Years

Funding Circle Review My Lender Experiences After 5 Years

The Difference Between a Second Mortgage and a Refinance.

Lending circle review. Take this into consideration when choosing a lender because prepayment penalties can. We work tirelessly to provide most competitive mortgages to Canadians. Lending Club has an A rating with the BBB and just a two-star rating based on customer reviews.

Funding Circle has applied to the Government-owned British Business Bank to become a provider under the Recovery Loan Scheme. Mortgages are massive commitments that can be stressful even if you are meeting your monthly repayments with ease. Registered in England Co.

Some Negative Reviews from Clients Regarding Upselling. Our firm belief is that all Canadians deserve competitive home loans regardless of income or credit standing. Share on Facebook Share on Twitter Share on LinkedIn.

- Some customers are not amused with Funding Circles persistence when it comes to calls offering their loan service. Lending circles allow you to access small-dollar low-cost loans funded by the pot that you and other circle members contribute to. Businesses applying here are typically not looking for fast money so theyre more patient.

Lending Circle is a Top Mortgage Company. We offer Direct Funding to borrowers for all type of Home Loans Private First Second. Still most borrowers are willing to make the tradeoff.

Compared to other companies who say they are easy to apply for Circle Back is Head and Shoulders Above all others. These formal and informal lending circles allow you to access small-dollar low-cost loans funded by the pot that you and other circle members contribute to. Income might fluctuate temporarily due to job changes lay-offs etc unforeseen life events can jeopardize a great credit score.

To review LendingClubs personal loans NerdWallet collected more than 40 data points from the lender interviewed company executives and compared the. Funding Circle and Lending Club are both legitimate lenders. August 31 2020 Lending-Circle-Wpadm.

Informal lending circles have been around for centuries but now some companies have taken that concept and adapted it so. Jillian on Glass canister. Circle back lending is the best peer to peer lending business Ive encountered so far- no scams upfront and honest about the loan fees and taxes and is very thorough about verifying that the loan borrower is in fact providing accurate information about themselves.

That said their team is highly responsive to such complaints and readily addresses such issues. Colin on Designer glasses. 𝐖𝐡𝐚𝐭 𝐭𝐨 𝐝𝐨 𝐖𝐡𝐞𝐧 𝐘𝐨𝐮𝐫𝐞 𝐒𝐭𝐫𝐮𝐠𝐠𝐥𝐢𝐧𝐠 𝐭𝐨 𝐏𝐚𝐲 𝐎𝐟𝐟 𝐘𝐨𝐮𝐫 𝐇𝐨𝐦𝐞 𝐋𝐨𝐚𝐧.

What is a Trusted Lending Circle aka ROSCA. Team WeTrust put together an informative animation that explains the benefits of an age-old savings and lendin. Fees are high at Funding Circle but at least theyre being transparent about them.

Borrowers which need more time to pay a loan back would probably do better. The primary complaint is that the lending experience is slow. Informal lending circles have been around for centuries but now some companies have taken that concept and adapted it so that it can also build your credit.

Funding Circle also has German Netherlands and USA divisions lending to businesses in their respective locations. Lending Clubs BBB page also been flagged to caution potential borrowers that scammers are fraudulently using the lenders. Funding Circle Limited is authorised and regulated by the Financial Conduct Authority under firm registration number 722513.

Specialist small business loans. Hence Funding Circle is best for companies which do not need to borrow much and can pay it all back not only on time but early. Funding Circle has an A rating with the Better Business Bureau BBB and a 3-star rating based on customer reviews.

However interest rates increase as terms get longer although there is no prepayment penalty. Circle Back Lending Is Great. Funding Circle is not covered by the Financial Services Compensation Scheme.

Terms from 2 to 5 years. Brian on Heritage backpack. The Funding Circle borrower reviews are mostly positive.

Investment through Funding Circle involves lending to small and medium sized businesses so your investment can go down as well as up. Yes CircleBack Lending Personal Loans may charge additional fees to borrowers who pay off their loans sooner than anticipated. If you find yourself regularly relying on short-term loans you might want to consider a lending circle instead.

Lending Circle will present you with multiple approvals. Yes CircleBack Lending Personal Loans may charge borrowers a late payment fee if you miss one of the monthly payments. Does CircleBack Lending Personal Loans charge prepayment fees.

Borrow 10000 to 500000. Lending Circle is a top Mortgage Company in Canada. No early settlement fees.

As of writing this Funding Circle Review figures suggest they have lent almost 5 billion to UK businesses from 81000 investors in the time they have been in business. What is a lending circle. 77 likes 5 talking about this.

A lending circle is a group of people who pitch in to lend each other money at low or.