Treasury Securities denominated in US. Testsieger Depot 052021 - Kostenlose Aktiensparpläne - riesige Auswahl an ETF-Sparplänen.

Anzeige ETF-Sparpläne ohne Orderkosten Gebühren besparen - ETF-Depot in 5 Min.

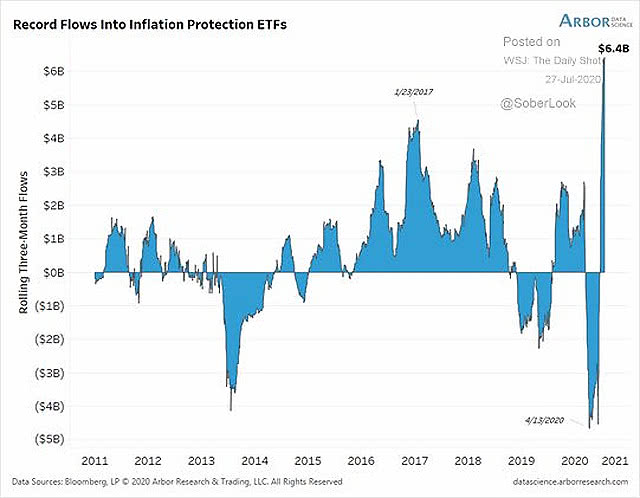

Inflation protected etf. TIP was one of the top ETFs last year in terms of new assets added. The fund seeks to track the Barclays Capital US. Treasury inflation-protected securities TIPS present a convenient way for investors to gain exposure to.

Treasury Inflation-Protected Securities TIPS 0-5 Years Index. IShares TIPS Bond ETF ticker. TIP Treasury inflation-protected securities or TIPS are a unique asset that provide protection against inflation because the principal value actually increases.

Testsieger Depot 052021 - Kostenlose Aktiensparpläne - riesige Auswahl an ETF-Sparplänen. The principal balance of TIPS increases as inflation. This ETF is used to satisfy demand for inflation hedging instruments.

Here are the best Inflation-Protected Bond ETFs. Exchange-traded funds ETFs that invest in US. Play Inflation-Protected ETFs Thanks to the growing reach of the ETF industry we now have several ETFs that offer exposure to tackle the inflationary pressure.

Investors seeking short-term TIPS with less interest rate risk can use the Vanguard Short-Term Inflation-Protected Securities ETF VTIP. SPDR Portfolio TIPS ETF. IShares TIPS Bond ETF ticker.

Of course the traditional way to hedge inflation is by investing in gold though a new-age investor now might prefer a cryptocurrency which they often refer to as digital gold Popular gold ETFs include the SPDR Gold Shares GLD with 70 billion in. Anzeige ETF-Sparpläne ohne Orderkosten Gebühren besparen - ETF-Depot in 5 Min. Inflation Protection Via ETFs Within each asset class our Real Return Strategy selects ETFs based upon their historical ability to keep pace during differing periods of inflation.

Dollars USD that meet certain screening criteria. It is an actively managed ETF providing broad-based exposure to the four. 19 Zeilen Inflation-Protect Bonds ETFs offer investors exposure to both US.

For anyone worried about the effect of inflation on their investments the obvious route is inflation-linked bond ETFs. One needs to ascertain the mix of sovereign and inflation protection that provides for both drawdown protection and capital preservation that complements the overall portfolio risk characteristics Backreedy said. The index is designed to track the performance of inflation-protected fixed rate US.

SPDR Blmbg Barclays 1-10 Year TIPS ETF. Schwab US TIPS ETF. Treasury Inflation-Protected Securities Treasury Inflation-Protected Securities are the most straightforward way to protect against a potential increase in inflation says Arnott.

This ETF has a weighted average maturity of 28 years and an expense ratio of 005. So here are a handful of exchange-traded funds or ETFs to consider if youve got an eye on inflation risks. One of the cheapest options among TIPS ETFs is the Vanguard Short-Term Inflation-Protected Securities ETF.

A Dynamic ETF with Inflation Protection Treasury-inflation protected securities TIPS can help stem the tide of rising inflation. Any good list of exchange-traded funds to buy for inflation will include a fund like iShares TIPS Bond ETF. Although buying a bond fund in an inflationary environment might seem counterintuitive to.

TIP Treasury inflation-protected securities or TIPS.