SPLITT REAL ESTATE TAX COMMISSION CALCULATOR. When including taxes that amount increased to 6087.

Prepaid Items Mortgage Escrow Account How Much Do They Cost

Prepaid Items Mortgage Escrow Account How Much Do They Cost

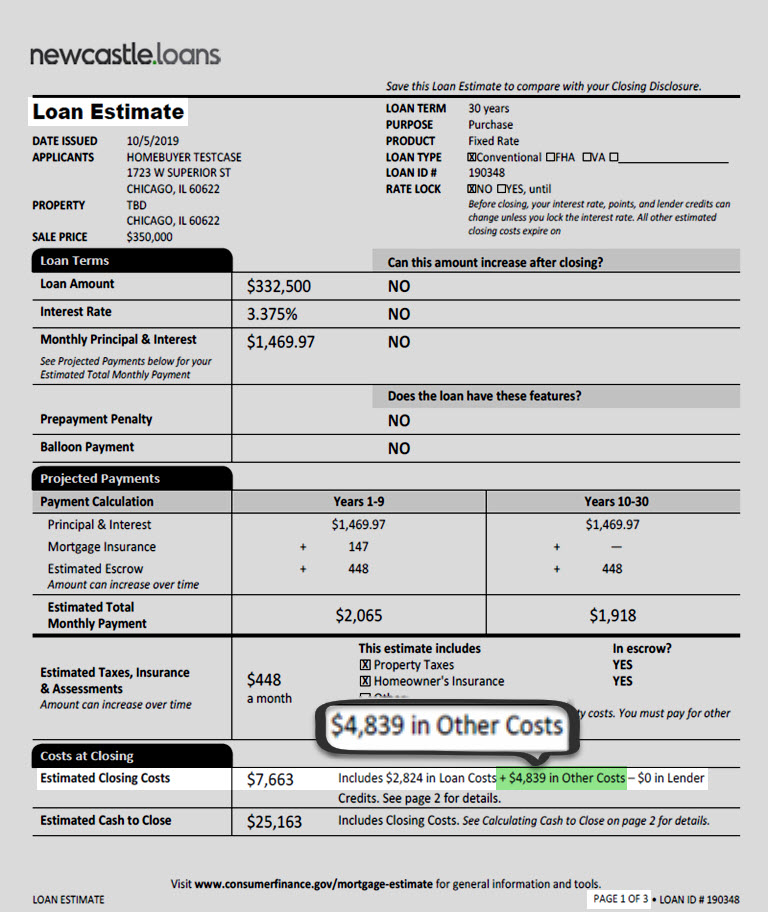

While each loan situation is different most closing costs typically fall into four categories.

Average closing costs in pa. Since 2006 the average minimum cost of recording fees has risen by 793 percent. Whats included in Pennsylvania closing costs. But the fact is that those few dollars here and there have added up to a big increase in closing costs on Pennsylvania families and businesses.

In Pennsylvania the average closing cost before taxes is roughly 4000. What is included in closing costs. What are closing costs.

Usually required by the lender title insurance is a policy that protects a propertys current. The largest closing costs when purchasing a home in Philadelphia are the realty transfer taxes. The average closing costs in 2020 were 3470 without taxes according to ClosingCorp data.

Typically home buyers will pay between about 2 to 5 percent of the purchase price of their home in closing fees. So if your home cost 150000 you might pay between 3000 and 7500 in closing costs. One-time closing costs and fees 6582 Origination charges title insurance inspection fees and other service fees.

Pennsylvania law requires real estate agents to provide both buyer and seller with Statements of estimated cost and return. 4 rows According to data from ClosingCorp the average closing cost in Pennsylvania is 10076 after. Closing Cost Calculator for PA With as few as 5 choices you can get an estimate to purchase a home in Pennsylvania.

A title search is performed to ensure that there are no outstanding liens or debts on the. In Pennsylvania the typical appraisal costs between 600 and 610. Commission on first dollar amount.

The closing cost estimate must be provided before an agreement of sale is executed. Thats more than three times the rate of inflation in the last 10 years. The Commonwealth of Pennsylvania collects 1 while the City of Philadelphia collects 3278 for a total of 4278.

52 rows The average closing costs without taxes come to 3339. Closing costs are typically about 3-5 of your loan amount and are usually paid at closing. Typically for a buyer closing costs can be about 5 to 6 of the homes value.

Luckily it is customary but not legally required. TOTAL CLOSING EXPENSES. For example closing costs on a 100000 mortgage might.

On average buyers pay roughly 3700 in closing fees according to a recent survey. Closing costs also known as settlement costs are the fees you pay when obtaining your loan. Assuming an average fee of 6 which is typical according to TIME Magazines Money 101 section it becomes clear why much of the financial burden is in seller closing costs.

The PA mortgage and closing cost calculator can return the down payment and closing costs for an FHA VA USDA and conventional home loan. Closing costs are typically 2-5 of your loan amount with a smaller percentage for larger loans. How Much are Typical Seller Closing Costs in Pennsylvania According to Zillow the median home in PA sold for 198377.

For example if a home is sold for 350000 this fee comes to an additional 21000. Pennsylvania Closing Cost and Mortgage Calculator. After taxes closing costs can average around 10000.

Each party to the sale must receive a written estimate of reasonably foreseeable expenses associated with the sale that the party may be expected. Keep in mind that youll pay more for an appraisal of a multi-family property.