Special 457 b catch-up contributions if permitted by the plan allow a participant for 3 years prior to the normal retirement age as specified in the plan to contribute the lesser of. A 457 b is offered to state and local government employees while a 457 f is for top-level nonprofit executives.

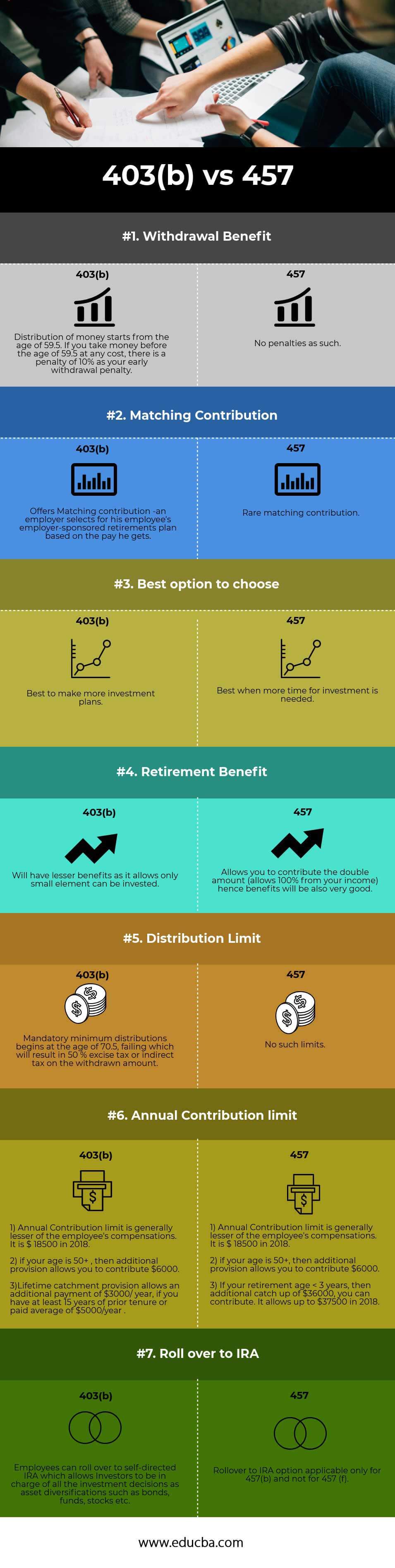

403 B Vs 457 Top 7 Differences To Learn With Infographics

403 B Vs 457 Top 7 Differences To Learn With Infographics

That doesnt mean you shouldnt record any activity within the Statement of Activities.

457 b plans for nonprofits. The deferrals and market related change in value are operating expenses. Basics of the Non-Governmental 457b Plan. Some highly paid executives at certain nonprofits like hospitals charities and unions are also able to use 457 b plans.

The following options are available. A 457 b is a type of tax-advantaged retirement plan for state and local government employees as well as employees of certain non-profit organizations. The executive team of non-profit entities can be provided a wonderful employee benefit above and beyond the traditional 401 k or 403 b plan that may offered by their agency.

These deferrals remain untaxed only so long as the amounts remain subject to a substantial risk of forfeiture. Non-Governmental 457 b Deferred Compensation Plans. For the 457 b plan I mean there is no change in net assets because the liabilities and the related assets change in the same direction and the same degree.

Quickly here are the basics of the non-governmental 457b. A 457 plan sponsor must be either. Government 457 plans are not subject to ERISA.

Internal Revenue Code Section 457 b provides tax-advantaged treatment for certain non-qualified deferred compensation plans. A 457 b plan allows an employee to defer compensation from their regular salary payments or additional amounts provided by the employer to the lesser of 18000 for 2017 or 100 of the participants includable compensation. A 501 c tax-exempt entity may also adopt a 457 b plan to benefit the executive team.

These plans are governed by IRS Code section 457 and the simplest plan is a so-called 457 b plan. Lets move on to the basics of 457b plans. Also known as a deferred compensation plan a 457 b plan is offered to state and local government employees such as police officers firefighters or other civil servants.

Sometimes called NQDC plans sometimes Top Hat Plansit can get confusing quickly. 457 b plans of state and local governments may allow catch-up contributions for participants who are aged 50 or older. The IRS recently announced plans for the Employee Plans Compliance Unit EPCU to undertake a study of organizations participating in non-governmental 457 b plans often referred to as Top Hat plans.

While the 457 b. Internal Revenue Code Section 457 provides tax-advantaged treatment for certain non-qualified deferred-compensation plans. A 457 plan has two types.

In the simplest terms 457 b plans are subject to contribution limits while 457 f plans allow for unlimited compensation deferrals. Governmental instrumentalities and certain other entities may also offer 457 b plans but this article focuses exclusively on plans for non-profits. With these plans you have some unique options that you will not see with any other plan types.

457 b Nongovernmental plan If you are an executive with a nonprofit entity your distribution will likely fall into this area. IRS Code Section 457 provides tax-deferred treatment for these non-qualified deferred-compensation plans. A governmental unit a state or political subdivision of a state or an agency or instrumentality of one of these or.

1 457 b For a 457 b plan. Non-government 457 plans may be exempt from ERISA requirements if they fall within the top-hat exemption In order to qualify for the top-hat exemption the plan must be unfunded and established and maintained for a select group of management or highly compensated employees. Both government and nongovernment employer 457 b plans offer eligible employees the chance to make pretax contributions of up to the lesser of.