Submit an enquiry at comparisch. Buyback guarantee on most loans a great diversity of loan originators loan types and an auto-invest function that is really easy to setup.

Why P2p Lending And Borrowing Is On The Rise Blend Ph Online Peer To Peer Funding Platform In The Philippines

Why P2p Lending And Borrowing Is On The Rise Blend Ph Online Peer To Peer Funding Platform In The Philippines

Developing P2P Peer-to-Peer Lending Platform with Blockchain Blockchain and the business model that characterizes peer-to-peer lending is a natural match.

P2p loan platform. The P2P lending site offers investments in lending companies from the Robocash Group which has been operating on the lending market since 2013. Browse through the most visible platforms using EUR GBP CHF much more. Released to the public in 2005 the platform focuses on consumer P2P lending and operates in the UK and the US through a partnership with six Credit Unions.

Since its launch Zopa has helped people lend more than 154 billion in P2P loans. P2P platforms provide loans targeting particularly into unbanked population which is estimated to be around 100 million in Indonesia. Investors must have a German bank account.

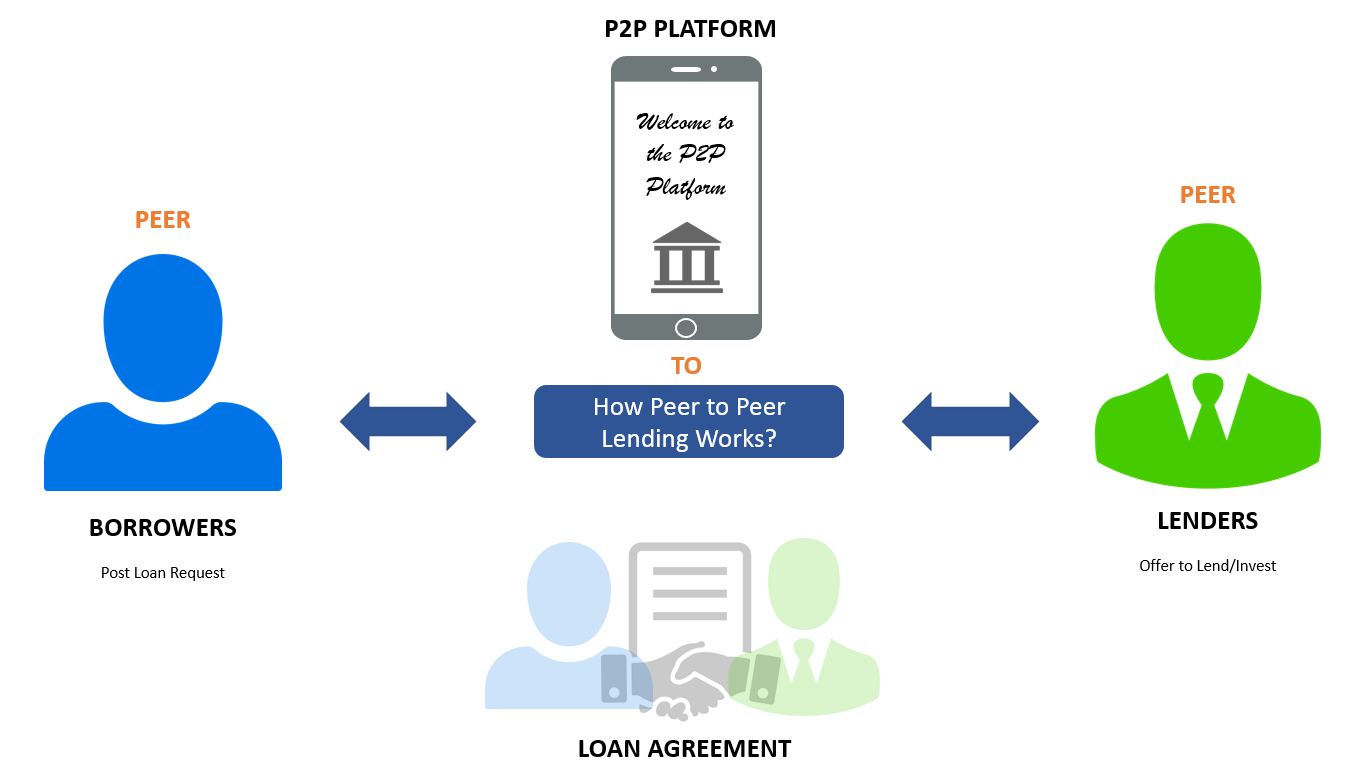

Their applications are believed to be stealing customers data such as phone contacts and photos. Their function is in practice to meet potential borrowers and lenders. P2P lending websites connect borrowers directly to investors as these lenders are called.

The most complete collection of 100 P2P Lending Platforms located in Europe. One of the largest European P2P platforms which offers German personal loans. One of the most popular P2P lending platforms is Mintos.

Get the right loan in just a few steps. Business loans are often backed by collateral and the purpose of those loans is to grow a business rather than to pay for consumer goods. Zopa is an industry pioneer and the very first P2P lending platform to ever be launched in the world.

Anzeige Find the loan thats right for you. P2P is one of the best investment options available in the market. P2B lending is an investment form where people invest in business loans on P2P lending marketplaces or P2P lending platforms.

Worth considering if you are German want to invest with an established site and are cautious about P2P. Each website sets the rates and the terms sometimes with investor input and enables the. The first P2P platform in the US Prosper allows you to invest in a diverse range of personal loans just like LendingClub.

Once youve opened an account you can choose to build your custom portfolio based on different risk ratings or use the Auto Invest tool to let the platform do it for you. It benefits the investorlender with higher returns on the capital. Get the right loan in just a few steps.

Most of these types of loans are unsecured loans most of which are aimed at small business. Business loans are very different to consumer loans which most P2P investors invest in. But instead of lending money to people you invest more directly in a share of for example real estate.

Crowdfunding platforms work very much like the P2P lending platforms. The sites providers P2P lending platform receive a percentage of the loan amount against their brokerage services. Thousands of P2P platforms are illegal.

The entire process is done on a P2P lending platform. P2P lending is a method through which lenders lend money to borrowers at a regular interest rate. Robocash is one of the most underrated P2P lending platforms in 2021.

P2P lending platforms connect borrowers directly to lenders where the lenders might be individuals or businesses and a corresponding interest is summed up to the lender when the loan. Submit an enquiry at comparisch. With blockchain technology p2p lending platforms can build new business models and enable transactions that are independent of trust relationships between lenders and borrowers.

The last platform I will mention here is PeerBerry which is a solid Peer-to-Peer lending platform in which I started to invest in back in 2018They also offer everything you need from a good Peer-to-Peer lending platform. The first P2P lending platform in the world Lendoit is a decentralized P2P lending platform connecting borrowers and lenders from all over the world in a trusted fast and easy way using the advantages of smart contracts and blockchain technologies. Anzeige Find the loan thats right for you.