This site was created to give taxpayers the opportunity to pay their taxes online. A Secure Online Service of Arkansasgov.

Online payments are available for most counties.

Arkansas taxes online. TurboTax Has A Variety Of Solutions And Tools To Help You Meet Your Tax Needs. Be sure to pay before then to avoid late penalties. 1900 West 7th Street Room 2140 Ragland Bldg.

Personal Property - Under Arkansas law ACA. For those paying taxes or who do not expect a refund nor need to pay taxes they can mail their return to Arkansas State Income Tax PO. Taxpayers may enter in the parcel number they would like to pay or search by name andor address to.

Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax. File a return on-line except Individual Income Tax File a return using XML return upload. To pay Arkansas income tax you can pay online using the Arkansas Taxpayer Access Point.

You can also mail your Arkansas income tax payment to. From there you can select Make Income Tax Payment under the Income Tax menu then select the payment method. TurboTax Has A Variety Of Solutions And Tools To Help You Meet Your Tax Needs.

The deadline for accepting online tax payments is Oct 15th. Welcome to the Columbia County Tax Collector ePayment Service Site. A processing fee will be added to the amount of taxes due when paying online.

No penalty will be assessed for online payments made before the deadline. If you choose to electronically file your State of Arkansas tax return by using one of the online web providers you are required to complete the form AR8453-OL. Pay-by-Phone IVR 1-866-257-2055.

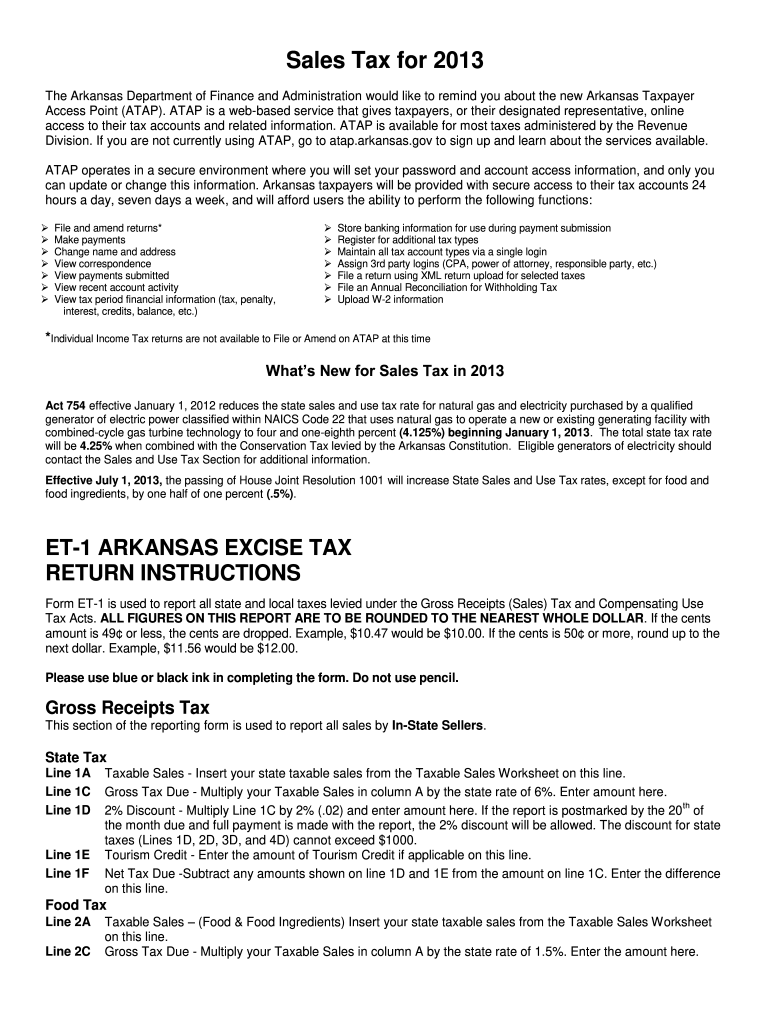

Arkansas Assessment Coordination Division. The address is on the form. ATAP is a web-based service that will give taxpayers or their designated representative online access to their tax accounts and offers the following services.

Box 2144 Little Rock AR 72201-2144. Anzeige From Simple To Complex Taxes Filing With TurboTax Is Easy. You can make an online payment there.

26-26-1202 states that personal property of any description shall be valued at the usual selling price of similar property at the time. Boone County does not receive any portion of these fees. Taxes paid online will be credited to.

Columbia County Property Tax. Get access to a complete suite of online tools for taxpayers. The deadline for accepting online tax payments is 1159pm Oct 15 2021.

Taxpayers who filed either by mailing a paper tax return or using e-file may use the credit card payment option. 15 2021 you can complete and sign 2020 Arkansas Tax Forms online here on eFile before you download print and mail them to the state tax agency. New users sign up at wwwataparkansasgov or click on the ATAP link on our web site wwwdfaarkansasgov.

No penalty will be assessed for online payments made before. The State of Arkansas also allows the credit card option to be used for any previous Individual Income Tax debts owed by taxpayers regardless of the tax year. The total amount will include a fee to allow for the electronic processing of the transaction through the states eGovernment service provider Arkansasgov.

Market Value - ACA. ATAP is a web-based service that allows taxpayers or their designated representative online access to their tax accounts and related information. This site was created to give taxpayers the opportunity to pay their personal and real estate taxes online.

Clark County Property Tax. 26-1-101 personal property is defined as Every tangible thing being the subject of ownership and not forming a part of any parcel of real property as defined. The total amount will be adjusted to allow for the electronic processing of the transaction through the states eGovernment service provider Arkansasgov.

Pay your state income tax owed check the status of your refund register a new business and more. Arkansas Taxpayer Access Point. Effective tax year 2011 the completed AR8453-OL along with the AR1000F or AR1000NR any W-2s or schedules are to be kept in your files.

Little Rock AR 72201. Anzeige From Simple To Complex Taxes Filing With TurboTax Is Easy. Welcome to the Clark County Tax Collector ePayment Service Site.

ATAP is available for most taxes administered by the Revenue Division. File Arkansas Income Tax Online - If you are looking for an efficient way to prepare your taxes then try our convenient online service. A Secure Online Service of Arkansasgov.

This service is not available for Estimated Tax Payments at this time. The statewide property tax deadline is October 15.

Ar Et 1 2012 2021 Fill Out Tax Template Online Us Legal Forms

Ar Et 1 2012 2021 Fill Out Tax Template Online Us Legal Forms

The Impact Of Tax Cuts On Arkansas Households Arkansas Tax Reform

The Impact Of Tax Cuts On Arkansas Households Arkansas Tax Reform

Prepare And Efile Your 2020 2021 Arkansas State Tax Return

Prepare And Efile Your 2020 2021 Arkansas State Tax Return

Lonoke County Property Tax A Secure Online Service Of Arkansas Gov

Lonoke County Property Tax A Secure Online Service Of Arkansas Gov

Johnson County Property Tax A Secure Online Service Of Arkansas Gov

Johnson County Property Tax A Secure Online Service Of Arkansas Gov

Department Of Finance And Administration

Department Of Finance And Administration

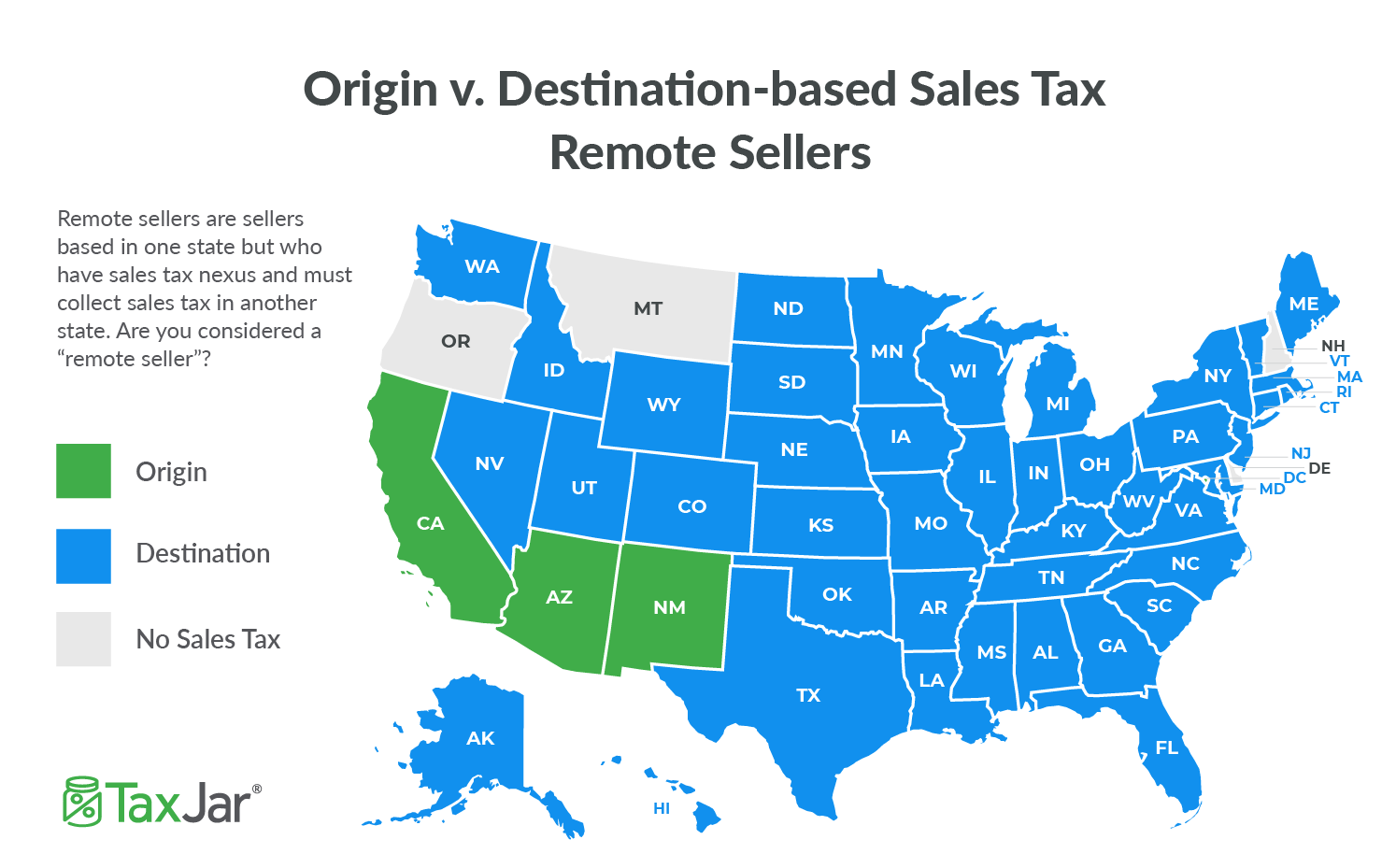

Origin Based And Destination Based Sales Tax Collection 101 Taxjar Blog

Origin Based And Destination Based Sales Tax Collection 101 Taxjar Blog

2019 Annual Franchise Tax Deadline May 1 2019

2019 Annual Franchise Tax Deadline May 1 2019

Understanding Your Arkansas Property Tax Bill

Understanding Your Arkansas Property Tax Bill

Arkansas Tax Forms And Instructions For 2020 Form Ar1000f

Arkansas Tax Forms And Instructions For 2020 Form Ar1000f

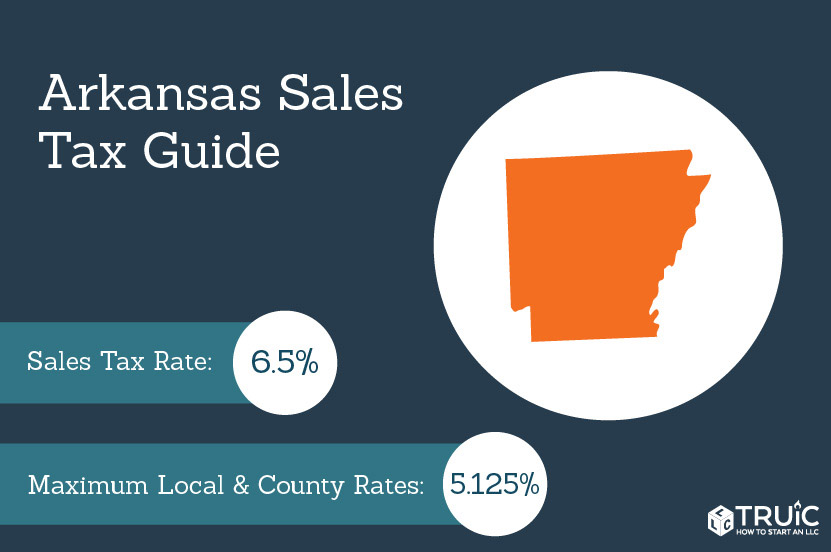

Arkansas Sales Tax Small Business Guide How To Start An Llc

Arkansas Sales Tax Small Business Guide How To Start An Llc

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.