Sign up for text alerts such as account balance. A custodial account is a financial account held in the name of a minor usually by a parent legal guardian or another relative.

Traditional And Roth Ira Cd Application Usaa

Traditional And Roth Ira Cd Application Usaa

You can decide how your children view and use their accounts.

Usaa custodial account. Choose whether or not your child can transfer money and make deposits. With your permission children age 13 to 18 can check their account balances transfer funds and deposit checks. To open a custodian account please visit one of our branch locations or call us at 703-706-5000 or 800-296-8882.

What is a custodial account. The solution is to create a Monthly Childrens Activity Account for each child in your family. If you need a Custodial IRA or 529 Plan theyre available.

Youve got your choice of different accounts to choose from when signing up for a USAA brokerage account. HelpOpens Popup Layer 210-531-USAA8722 Call 210-531-8722 or 800-531-8722. If you are a parent or guardian of a young person this gives you the opportunity to save and invest for your child while retaining full control of the account until they reach adulthood.

All amounts contributed to your IRA custodial account will not be forfeitable. Minor Accounts This is a youth account that gives a child more control over their account than a custodian account. We may however be required by court.

Custodial accounts under the Uniform Gifts to Minors Act UGMA or Uniform Transfers to Minors Act UTMA are accounts created under a states law to hold gifts or transfers that a minor has received. If youre a business owner and need an SEP or SIMPLE IRA Savings Incentive Match Plan for Employees you can take your pick. USAA 8722 8722 on ATT Sprint T-Mobile and VerizonTo call by mobile phone ATT Sprint T-Mobile and Verizon.

The accounts are managed by a custodian and once a gift or transfer is made to an account the gift or transfer cannot be revoked. TWO The Custodial Account The USAA Federal Savings Bank IRA is a custodial account established for your exclusive benefit or that of your named beneficiaries as described in Section 408 of the Internal Revenue Code Code. You can earn cashback and rack up points with the reward system.

USAA proudly serves millions of military members and their families with competitive rates on insurance banking and investment services. Extensive choice for different accounts. USAA Mutual Funds Account This account can hold up to 50 USAA mutual funds in a variety of fund categories including Equity primarily growth funds Index stock exchange indices Taxable Bond Tax-Exempt Bond Money Market lower interest capital preservation funds Asset Allocation for one-stop diversification shopping and Target Retirement Funds based on your projected retirement date.

Plus control updates happen in real time so you can make changes whenever you want. Our kids saving accounts come with tools you can use to teach your child smart money management. USAA Mutual Funds and the Plan are distributed by Victory Capital Services Inc member FINRA an affiliate of Victory Capital.

For a workable Childrens Activity Account. Get protection for valuables with over 12 different types of coverage. A custodial account is a trust account.

We may however be required by court. USAA UGMA and UTMA Accounts. Victory Capital means Victory Capital Management Inc the investment adviser of the USAA Mutual Funds and USAA 529 College Savings Plan Plan.

We may however be required by court. The Childrens Activity Account serves as a way to track account deposit and spend for each childs various activity. This kind of account provides you with maximum flexibility in how you choose to invest and use the funds.

Theres also joint accounts trusts and conservatorship accounts. TWO The Custodial Account The USAA Federal Savings Bank IRA is a custodial account established for your exclusive benefit or that of your named beneficiaries as described in Section 408 of the Internal Revenue Code Code. The purpose of the Childrens Activity Account is to reduce the potentially large monthly budget swings for childrens activities and provide a way to easily account for each childs expenses.

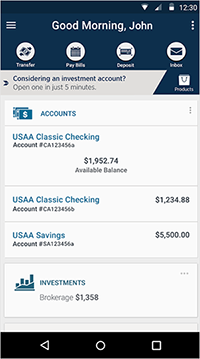

The market has a fiduciary responsibility to pro-tect and preserve the funds entrusted to it for. Manage your finances investments insurance and much moreall from one convenient app. USAA is not affiliated with Victory Capital or VCS.

These custodial accounts let you invest money on behalf of a child wholl get access to it at 18 or 21 depending on the state. All amounts contributed to your IRA custodial account will not be forfeitable. USAA and the USAA logos are registered trademarks and the USAA.

USAA Mobile gives you immediate and secure account access from your mobile device. All payments for livestock by buyers and other funds deposited into the custodial account are trust funds not owned by the market. TWO The Custodial Accoun t The USAA Federal Savings Bank IRA is a custodial account established for your exclusive benefit or that of your named beneficiaries as described in Section 408 of the Internal Revenue Code Code.

All amounts contributed to your IRA custodial account will not be forfeitable. Youll be able to. Lish and maintain a custodial account.

If needed you can help update or change online IDs passwords and PINs.

Usaa Investments Review Stock Trading Account 2021

Usaa Investments Review Stock Trading Account 2021

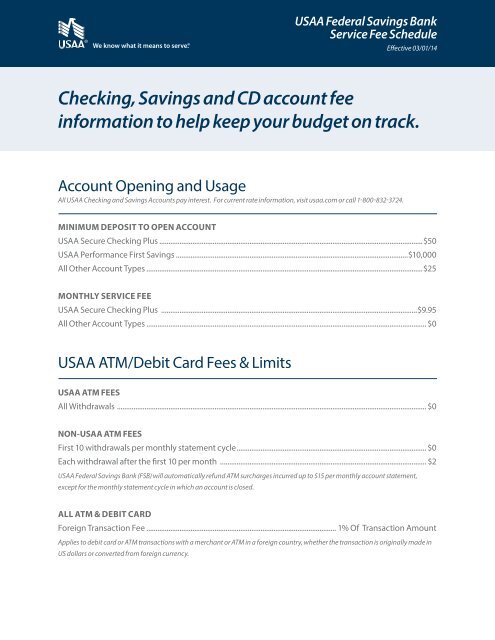

Depository Agreement And Disclosures Usaa

Depository Agreement And Disclosures Usaa

Usaa Ira Fees Rates Review Roth Traditional Ira Account 2021

Usaa Ira Fees Rates Review Roth Traditional Ira Account 2021

Usaa Bank Savings Cds Checking Accounts Finder Com

Usaa Bank Savings Cds Checking Accounts Finder Com

Financial Aid Infographic Usaa

Financial Aid Infographic Usaa

Usaa Bank Review Smartasset Com

Usaa Bank Review Smartasset Com

Usaa Bank Review Smartasset Com

Usaa Bank Review Smartasset Com

Usaa Bank Review Smartasset Com

Usaa Bank Review Smartasset Com

Veterans With Usaa To See Reduced Cash Yields Following Charles Schwab Deal Financial Planning

Veterans With Usaa To See Reduced Cash Yields Following Charles Schwab Deal Financial Planning

Usaa Investments Review Stock Trading Account 2021

Usaa Investments Review Stock Trading Account 2021

Usaa Investments Review Stock Trading Account 2021

Usaa Investments Review Stock Trading Account 2021

Usaa Ira Fees Rates Review Roth Traditional Ira Account 2021

Usaa Ira Fees Rates Review Roth Traditional Ira Account 2021

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.