Many hospital indemnity insurance plans pay based on a fixed benefit. A hospital indemnity insurance plan can cover a percentage of your income while youre out of work and in the hospital.

Is Hospital Indemnity Insurance Worth It Glg America

Is Hospital Indemnity Insurance Worth It Glg America

The monthly premium for a hospital indemnity plan typically will depend on the amount of coverage you select as well as your age gender and health.

Hospital indemnity plans for individuals. Hospital Indemnity Recovery Care Critical Illness Article Contents. Hospital indemnity insurance is a voluntary benefit that helps cover out-of-pocket expenses related to hospital stays outpatient surgery inpatient services emergency room. Hospital indemnity insurance also known as supplemental hospitalization or hospital insurance hospital cash plans healthcare indemnity medical indemnity health benefit indemnity fixed indemnity health insurance indemnity medical plan or health benefit indemnity insurance are policies for individuals and families that will pay a set amount of money when you receive covered medical services.

The plan may pay for example. The plan also acts as a financial backup for some of the out-of-pocket expenses that most health care coverage plans will not cover. Most major medical insurance is not designed to cover all hospitalization costs and when a hospital stay is necessary the immediate cost of care can be mor.

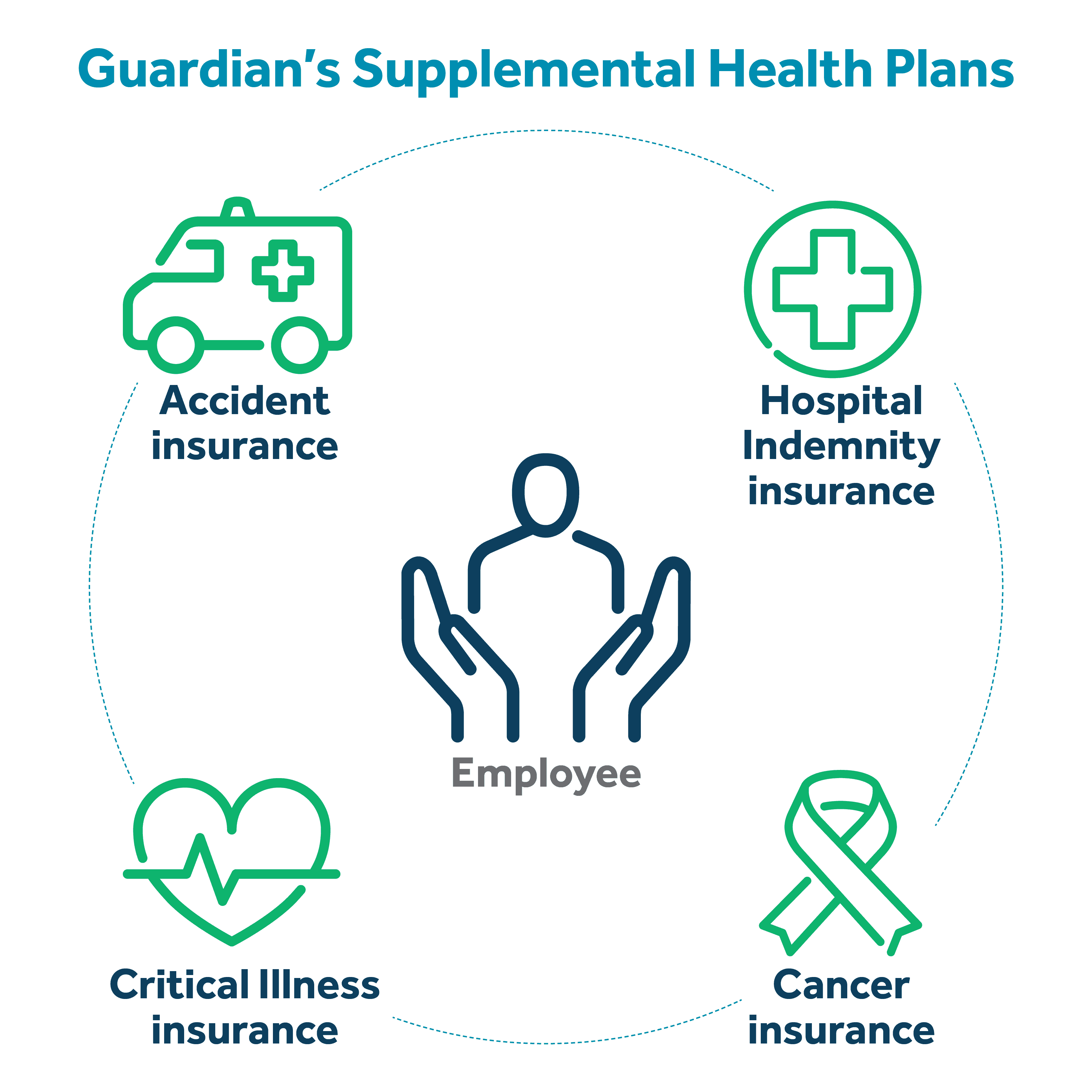

Planned or unplanned a trip to the hospital can be scary. These plans were not designed to be supplements to other health insurance plans nor replace any traditional health insurance plan that you might have. Like with hospital indemnity insurance CII pays a lump sum if you qualify for benefits.

There are no networks copays deductibles or coinsurance restrictions. For example plans that offer fewer benefits start at just under 7 per month. For example you are admitted to the hospital for a sickness.

This insurance may not be available in all states and where available benefits will vary. The Hospital Indemnity Plan is NOT a comprehensive major medical plan. No matter which hospital you choose youll be covered.

Monthly premiums for a plan that covers less can be as little as 5. Hospital Indemnity insurance helps keep your finances on track when youre in the hospital. And like all of our products benefits will be paid directly to you regardless of your other coverage.

So the plan pays you 10250 directly which we recommend. Hospital indemnity insurance is similar to other types of supplemental insurance but there are key differences in what is and isnt covered. 3 9000 for being in the hospital for 3 days.

A Hospital Indemnity Insurance policy is flexible and can be tailored to your needs and budget. Our Hospital Indemnity plan is designed specifically to help offset those out-of-pocket expenses when you or a family member has a hospital stay. Recovery Care Supplemental Insurance Plans.

Plans that offer a wider range of benefits can vary anywhere from 19 up to 463 per month. The monthly cost of a hospital indemnity plan will depend on your plan choice age gender and possibly your tobacco use. You can use the money for whatever you need.

To help you manage the gaps left by qualified major medical and limited benefit plans ManhattanLife offers two hospital indemnity plan Affordable Choice and CentralChoice. 2 1000 for the hospital admittance. Benefits will be paid in addition to any other insurance plan the policyholder might have.

Group Hospital Indemnity insurance can help cover unexpected out-of-pocket expenses such as copays deductibles and out-of-network charges as well. It provides a cash benefit paid directly to you which can help with your out-of-pocket expenses. However with the higher deductibles brought on by the Affordable Care Act these plans are more likely to be offered at work during your core benefits enrollment alongside critical illness and accident plans.

One similar type of insurance is critical illness insurance CII. Individual Supplemental Insurance Plans. Hospital Indemnity Plans are limited benefit plans that pay all benefits directly to the consumer.

Hospital indemnity plans have been available privately and at work through companies like AFLAC Allstate and MetLife for a long time. Many plans extend coverage to spouses children and other dependents and hospital indemnity policies are often used along with other insurance coverage plans to pay for the entire hospital bill owed. A plan that covers more services can cost more from 27 per month.

There are two costs to major medical insurance whenever you are hospitalized the health insurance premium and the cost of actually using the insurance. To apply just answer a few yes or no questions about your health history. It can be even more frightening to know that your medical insurance probably wont cover all your costs.

Hospital indemnity insurance from UnitedHealthcare complements your current medical coverage by helping to ease the financial impact of hospitalization. One form of this plan is known as hospital confinement indemnity insurance. Hospital Indemnity Supplemental Insurance Plans.

Making Hospital Indemnity Part Of The Mix

Making Hospital Indemnity Part Of The Mix

What S The Difference Between Hospital Indemnity Policies And Accident Insurance Sbma Benefits

What S The Difference Between Hospital Indemnity Policies And Accident Insurance Sbma Benefits

Hospital Indemnity Insurance The Hartford

Hospital Indemnity Insurance The Hartford

What Is The Lasso Hospital Indemnity Plan Hip And How Does It Work

What Is The Lasso Hospital Indemnity Plan Hip And How Does It Work

Sun Life Offers Hospital Indemnity Insurance With New Extended Hospitalization Coverage To Help Members Close Coverage Gaps Nasdaq

Sun Life Offers Hospital Indemnity Insurance With New Extended Hospitalization Coverage To Help Members Close Coverage Gaps Nasdaq

Check Out Medico S Hospital Indemnity Insurance Empower Brokerage

Check Out Medico S Hospital Indemnity Insurance Empower Brokerage

Risk Management And Insurance Hospital Indemnity Plan

Risk Management And Insurance Hospital Indemnity Plan

Selling Hospital Indemnity Coverage Senior Market Advisors

Selling Hospital Indemnity Coverage Senior Market Advisors

Fixed Indemnity Health Coverage Is A Problematic Form Of Junk Insurance

Fixed Indemnity Health Coverage Is A Problematic Form Of Junk Insurance

Indemnity Health Insurance Picshealth

Indemnity Health Insurance Picshealth

Additional Products Services Senior Financial Group

Additional Products Services Senior Financial Group

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.